Household budget worksheet dave ramsey free#

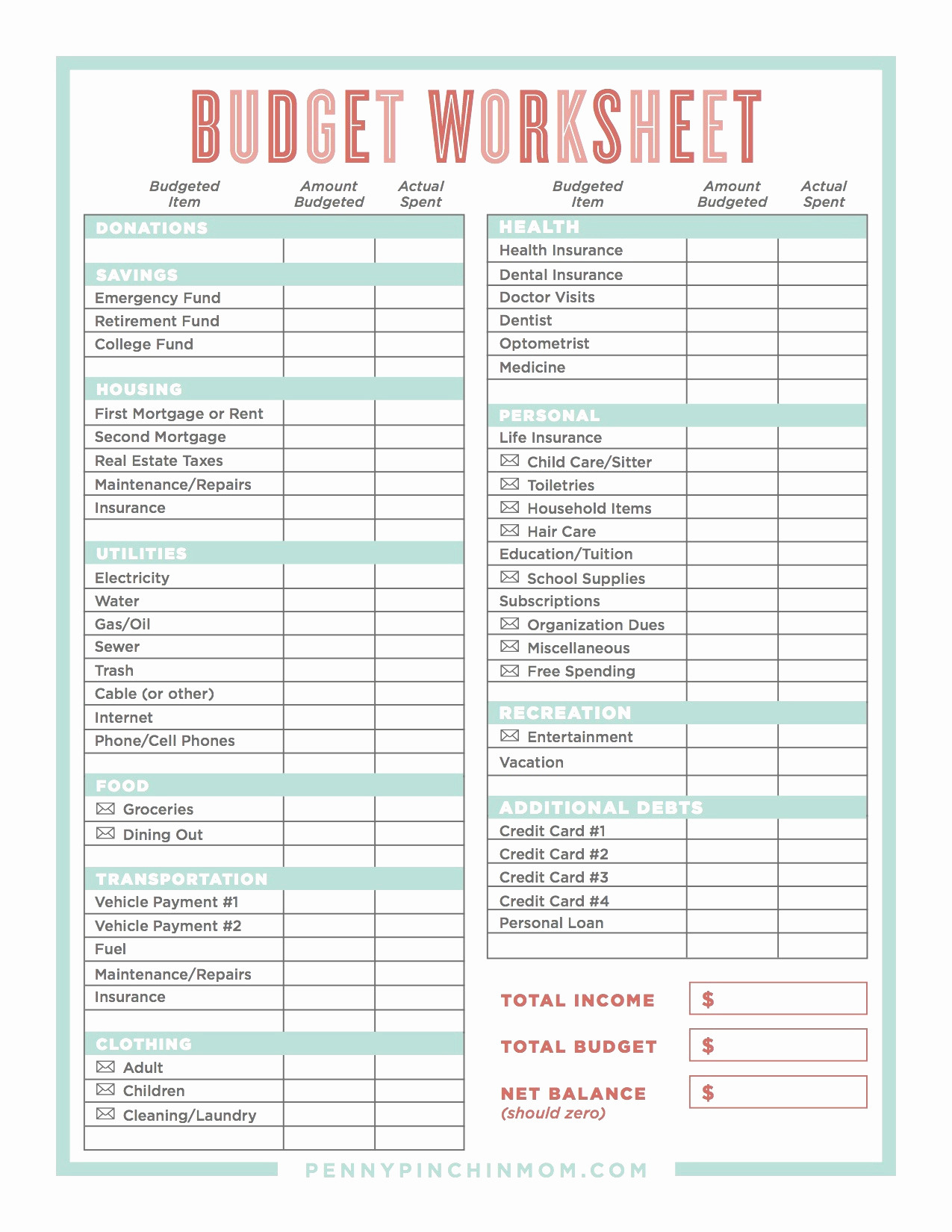

Most expenses will fit into the categories I recommend in this guide, but feel free to come up with your own too! You need to include every expense you’ll have for the month. If it’s money that comes into your household’s bank account, it’s income! This includes paychecks, side hustles, residual income, child support and any other cash you expect to bring in. When it’s time to start your budget (we’ll get there in the next section), these are the numbers you’ll need:Īdd up all the money you bring in and put this total at the top of your budget.

You can create a zero-based budget the old-fashioned way with a sheet of paper, or you can use our super easy and free budgeting app, EveryDollar, inside Ramsey+. So, if you keep going way over or you’re not making progress on your money goals, you really need to buckle down and stick to what you decided you could afford before the month began. It’s not just a way to track spending your money on whatever you want.

Your zero-based budget is your plan for the month. Your future self will be so thankful you did!īefore you actually start budgeting, let’s talk about what we’re aiming for: a zero-based budget.Ī zero-based budget doesn’t mean you have zero dollars in your bank account-it means you’ve subtracted all your monthly expenses from your monthly income until the amount left is zero. So, keep in mind that budgeting on Baby Step 1 means squeezing every last penny out of each budget category-clipping coupons, eating rice and beans, and selling so much stuff the kids think they’re next! Right now, you’re trading the short-term rush of immediate gratification for the peace of financial success over the long term. New to budgeting and on Baby Step 1? We’re so glad you’re here! This guide will help you start your first monthly budget. Following these tips, it is possible that you will be able to successfully utilize a budget worksheet to manage your personal financial situation. Remember to be reasonable when setting the budget and then review it frequently. You can track your income and expenses, and plan ahead for the coming years. By using a financial worksheet that you can take control over your finances. In the creation and use of a budget worksheet is an important step toward achieving financial stability.

0 kommentar(er)

0 kommentar(er)